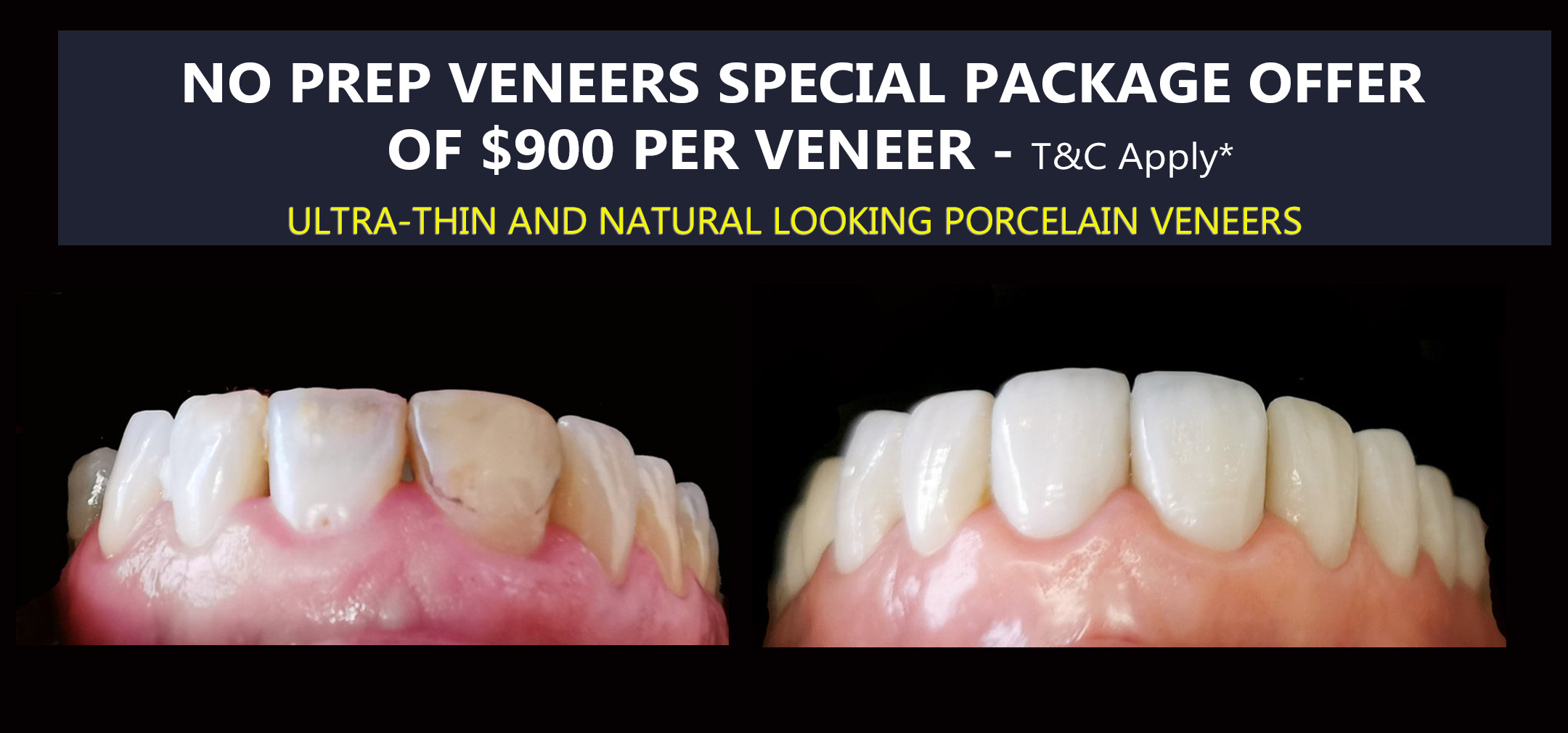

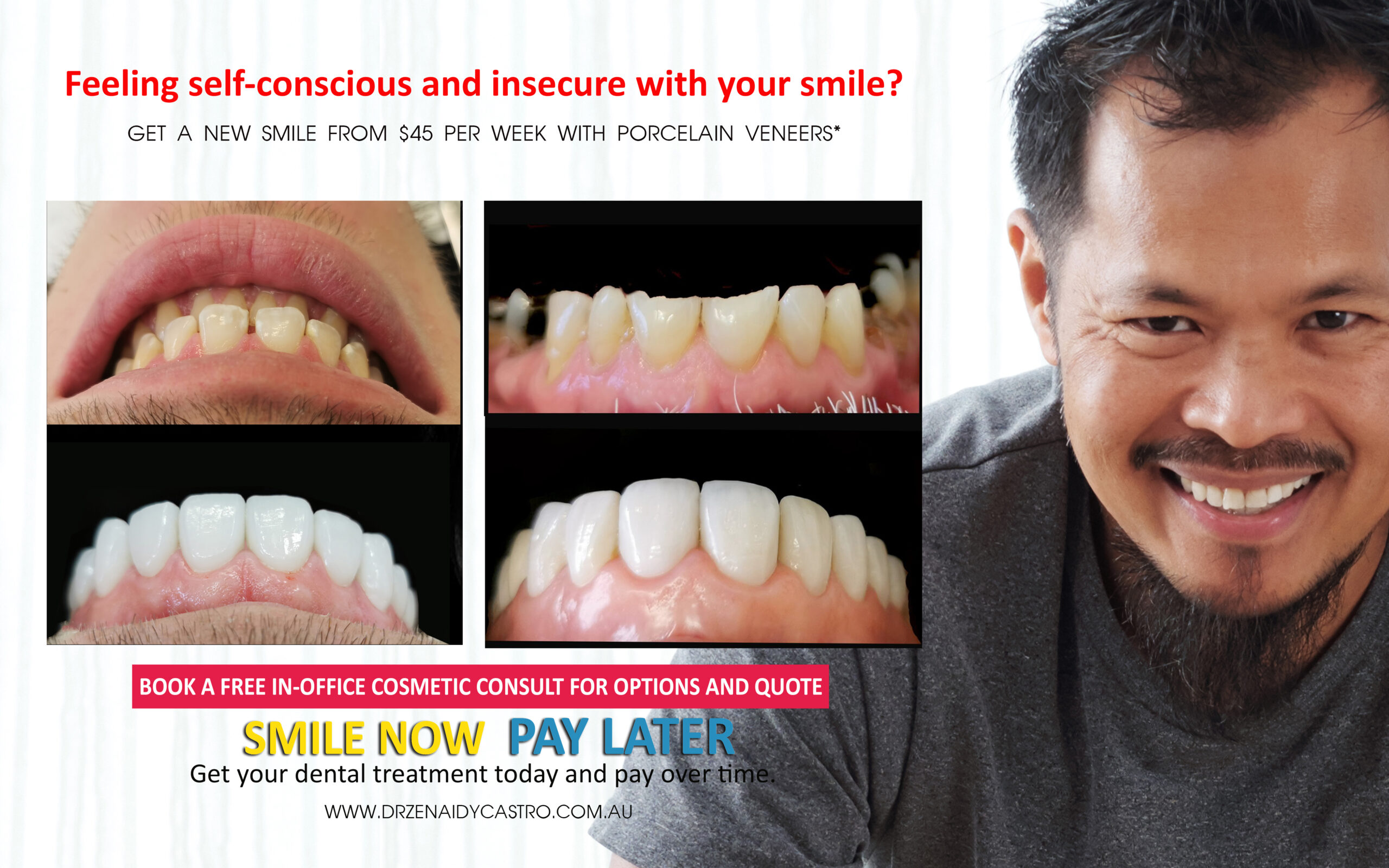

Review the important terms and conditions that apply to this offer.

Review the important terms and conditions that apply to this offer.

✨ Key Highlights About Dental Insurance in Australia:

✨ Over 13 million Australians have private health insurance with dental coverage

✨ Average waiting periods range from 2–12 months for major dental procedures

✨ Annual benefit limits typically range from $500–$2,500 per person

✨ Preventive care often covered at 100% with no waiting periods

✨ Major dental work usually covered at 50–80% after waiting periods

✨ Orthodontic coverage available but often requires separate or higher-tier policies

✨ Pre-existing conditions may not be covered for 12 months

✨ Choice of dentist varies between providers – some require network providers

???? Call Vogue Smiles Melbourne and Noble Park today for a comprehensive general and smile makeover treatment — offering competitive pricing, bundled porcelain veneer specials, interest-free dental plans, and Superannuation access assistance.

REQUEST AN ONLINE PERSONALIZED QUOTE ➤

REQUEST FOR A FREE TELECONSULTATION ➤

Dental care in Australia can be expensive, but having the right dental insurance can make all the difference. Whether you’re living in Melbourne CBD & Noble Park North or anywhere across Australia, understanding how dental insurance works is crucial for maintaining your oral health without breaking the bank. This comprehensive guide will walk you through everything you need to know about dental insurance in Australia.

With dental treatment costs continuing to rise across Australia, having proper dental insurance has become more important than ever. The average Australian spends over $1,200 annually on dental care, and major procedures can cost thousands of dollars. Understanding your insurance options helps you make informed decisions about your oral health care while managing costs effectively.

What is Dental Insurance and Why Do You Need It?

Dental insurance in Australia is typically part of private health insurance extras cover. Unlike medical insurance, dental insurance helps cover the costs of routine dental care, preventive treatments, and major dental procedures. Here’s why it’s essential:

- Cost Protection: Dental treatments can range from $150 for a basic cleaning to $5,000+ for complex procedures

- Preventive Focus: Regular check-ups and cleanings help prevent costly major treatments later

- Peace of Mind: Know you’re covered when dental emergencies arise

- Access to Quality Care: Many policies provide access to preferred provider networks

- Family Coverage: Protect your entire family’s oral health with comprehensive coverage

- Emergency Protection: Unexpected dental injuries or infections can be financially devastating without coverage

The Australian dental care system relies heavily on private practice, making dental insurance crucial for affordable access to care. Unlike many countries with government-funded dental programs, Australia’s public dental services are limited, primarily serving emergency cases and low-income patients with long waiting lists.

Types of Dental Coverage in Australia

Understanding the different types of dental coverage helps you choose the right policy for your needs. Australian dental insurance typically falls into these categories:

General Dental (Preventive Care)

- Regular check-ups and examinations every 6 months

- Professional cleaning and scaling treatments

- X-rays and diagnostic procedures including digital imaging

- Fluoride treatments for cavity prevention

- Oral health education and advice

- Usually covered at 100% with no waiting periods

- Often includes additional preventive services like fissure seals

Basic Dental (Restorative Care)

- Fillings using composite resin or amalgam materials

- Simple extractions for damaged or impacted teeth

- Basic gum treatments including deep cleaning

- Emergency treatments for pain relief

- Basic root canal treatments on front teeth

- Usually covered at 70-100% after 2-6 month waiting periods

- May include some minor oral surgery procedures

Major Dental (Complex Procedures)

- Crowns and bridges for tooth restoration

- Complex root canal treatments on molars

- Dentures (partial and complete)

- Dental implants and related procedures

- Major oral surgery including wisdom tooth removal

- Periodontal surgery for advanced gum disease

- Usually covered at 50-80% after 6-12 month waiting periods

- Often subject to annual benefit limits and pre-approvals

Orthodontic Treatment

- Traditional metal braces for children and adults

- Clear aligners like Invisalign

- Ceramic and lingual braces

- Retainers and follow-up care

- Orthognathic surgery when medically necessary

- Often requires separate coverage with 12-24 month waiting periods

- May have lifetime limits in addition to annual limits

COMPREHENSIVE AUSTRALIAN DENTAL INSURANCE PROVIDER COMPARISON

| Provider (Website) |

Basic |

Comprehensive |

Top |

Contact |

Limit |

Wait |

Features |

| Medibank (medibank.com.au) |

$25–35 |

$45–65 |

$80–120 |

132 331 |

$500–2,000 |

2–12 mo |

No Gap, 24/7 nurse |

| Bupa (bupa.com.au) |

$28–40 |

$50–70 |

$85–130 |

134 135 |

$600–2,500 |

2–12 mo |

Wellness, global cover |

| HCF (hcf.com.au) |

$22–32 |

$42–62 |

$75–115 |

13 13 34 |

$500–2,200 |

2–12 mo |

Rewards, coaching |

| NIB (nib.com.au) |

$26–38 |

$48–68 |

$82–125 |

13 14 63 |

$550–2,300 |

2–12 mo |

Digital tools, travel |

| Australian Unity (australianunity.com.au) |

$24–35 |

$44–64 |

$78–118 |

13 29 39 |

$500–2,100 |

2–12 mo |

Pharmacy, wellness |

| CBHS (cbhs.com.au) |

$20–30 |

$38–58 |

$70–110 |

1300 174 534 |

$450–2,000 |

2–12 mo |

Gov staff, discounts |

| Teachers Health (teachershealth.com.au) |

$23–33 |

$43–63 |

$76–116 |

1300 728 188 |

$500–2,150 |

2–12 mo |

Edu focus, health plans |

| GMHBA (gmhba.com.au) |

$21–31 |

$41–61 |

$74–114 |

1300 464 622 |

$480–2,080 |

2–12 mo |

Regional, personal care |

| Defence Health (defencehealth.com.au) |

$25–36 |

$46–66 |

$79–119 |

1800 335 642 |

$520–2,120 |

2–12 mo |

Military benefits |

| Peoplecare (peoplecare.com.au) |

$19–29 |

$37–57 |

$68–108 |

1300 650 102 |

$450–1,950 |

2–12 mo |

Not-for-profit care |

MEDIBANK

- Website: medibank.com.au

- Basic Coverage Cost: $25-35/month

- Comprehensive Coverage Cost: $45-65/month

- Top Coverage Cost: $80-120/month

- Contact Number: 132 331

- Annual Limit: $500-$2,000

- Waiting Periods: 2-12 months

- Special Features: No Gap Dental Network, 24/7 health advice, nurse hotline

BUPA

- Website: bupa.com.au

- Basic Coverage Cost: $28-40/month

- Comprehensive Coverage Cost: $50-70/month

- Top Coverage Cost: $85-130/month

- Contact Number: 134 135

- Annual Limit: $600-$2,500

- Waiting Periods: 2-12 months

- Special Features: More for Teeth network, overseas coverage, wellness programs

HCF

- Website: hcf.com.au

- Basic Coverage Cost: $22-32/month

- Comprehensive Coverage Cost: $42-62/month

- Top Coverage Cost: $75-115/month

- Contact Number: 13 13 34

- Annual Limit: $500-$2,200

- Waiting Periods: 2-12 months

- Special Features: More for Teeth network, member rewards, health coaching

NIB

- Website: nib.com.au

- Basic Coverage Cost: $26-38/month

- Comprehensive Coverage Cost: $48-68/month

- Top Coverage Cost: $82-125/month

- Contact Number: 13 14 63

- Annual Limit: $550-$2,300

- Waiting Periods: 2-12 months

- Special Features: First Choice network, travel insurance, digital health tools

AUSTRALIAN UNITY

- Website: australianunity.com.au

- Basic Coverage Cost: $24-35/month

- Comprehensive Coverage Cost: $44-64/month

- Top Coverage Cost: $78-118/month

- Contact Number: 13 29 39

- Annual Limit: $500-$2,100

- Waiting Periods: 2-12 months

- Special Features: Wellness programs, pharmacy discounts, member benefits

CBHS

- Website: cbhs.com.au

- Basic Coverage Cost: $20-30/month

- Comprehensive Coverage Cost: $38-58/month

- Top Coverage Cost: $70-110/month

- Contact Number: 1300 174 534

- Annual Limit: $450-$2,000

- Waiting Periods: 2-12 months

- Special Features: Government employee focus, competitive rates, family discounts

TEACHERS HEALTH

- Website: teachershealth.com.au

- Basic Coverage Cost: $23-33/month

- Comprehensive Coverage Cost: $43-63/month

- Top Coverage Cost: $76-116/month

- Contact Number: 1300 728 188

- Annual Limit: $500-$2,150

- Waiting Periods: 2-12 months

- Special Features: Education sector focus, family discounts, health programs

GMHBA

- Website: gmhba.com.au

- Basic Coverage Cost: $21-31/month

- Comprehensive Coverage Cost: $41-61/month

- Top Coverage Cost: $74-114/month

- Contact Number: 1300 464 622

- Annual Limit: $480-$2,080

- Waiting Periods: 2-12 months

- Special Features: Regional focus, community-owned, personal service

DEFENCE HEALTH

- Website: defencehealth.com.au

- Basic Coverage Cost: $25-36/month

- Comprehensive Coverage Cost: $46-66/month

- Top Coverage Cost: $79-119/month

- Contact Number: 1800 335 642

- Annual Limit: $520-$2,120

- Waiting Periods: 2-12 months

- Special Features: Defence force focus, overseas coverage, deployment benefits

PEOPLECARE

- Website: peoplecare.com.au

- Basic Coverage Cost: $19-29/month

- Comprehensive Coverage Cost: $37-57/month

- Top Coverage Cost: $68-108/month

- Contact Number: 1300 650 102

- Annual Limit: $450-$1,950

- Waiting Periods: 2-12 months

- Special Features: Not-for-profit, competitive pricing, member focus

Key Features to Consider When Choosing Dental Insurance

Selecting the right dental insurance policy requires careful consideration of several important factors. Here are the key features you should evaluate:

Annual Benefit Limits

This is the maximum amount your insurer will pay for dental treatments each year. Limits typically range from $500 to $2,500 per person. Consider your dental health needs when choosing:

- Low limits ($500-$800): Suitable for basic preventive care and occasional minor treatments

- Medium limits ($800-$1,500): Good for regular dental maintenance plus occasional restorative work

- High limits ($1,500-$2,500+): Better for major dental work, orthodontics, or multiple family members

- Unlimited benefits: Some premium policies offer unlimited or very high annual limits

Waiting Periods

Most dental insurance policies have waiting periods before you can claim benefits. Understanding these is crucial:

- No waiting period: Preventive care (check-ups, cleaning, x-rays)

- 2-6 months: Basic restorative treatments (fillings, simple extractions)

- 6-12 months: Major dental procedures (crowns, bridges, dentures)

- 12-24 months: Orthodontic treatments and pre-existing conditions

- Emergency provisions: Some immediate coverage for accidents and emergencies

Coverage Percentages

Different treatments are covered at different percentages of the total cost:

- Preventive care: Usually 100% coverage with no out-of-pocket costs

- Basic dental: Typically 70-100% coverage depending on policy level

- Major dental: Usually 50-80% coverage with higher out-of-pocket costs

- Orthodontics: Often 50-70% coverage with separate annual limits

Need Expert Dental Care in Melbourne?

Our experienced team at Melbourne CBD & Noble Park North provides comprehensive dental services. We work with all major insurance providers to maximize your benefits.

???? Call us today: 9629-7664 | 0413 014 122

???? Book Online Appointment

???? Free Teleconsult Available

Understanding Coverage Percentages and Out-of-Pocket Costs

Dental insurance doesn’t typically cover 100% of all treatments. Understanding coverage percentages helps you budget for dental care effectively:

Typical Coverage Percentages

- Preventive Care: 100% coverage (no out-of-pocket costs)

- Basic Dental: 70-100% coverage

- Major Dental: 50-80% coverage

- Orthodontics: 50-70% coverage (if included)

How Out-of-Pocket Costs Work

Even with insurance, you’ll often pay some costs yourself. Here’s how it typically works:

- Gap payments: The difference between what your dentist charges and what insurance covers

- Excess fees: Some policies require you to pay an annual excess before benefits kick in

- Above-limit costs: Any treatments exceeding your annual benefit limit

- Non-covered services: Cosmetic treatments often not covered by insurance

How to Choose the Right Dental Insurance Provider

Selecting the best dental insurance provider depends on your individual needs and circumstances. Consider these factors when making your decision:

Assess Your Dental Health Needs

- Current oral health: Do you need immediate treatment or just preventive care?

- Family requirements: Consider coverage for children’s orthodontics and family dental needs

- Age factors: Older adults may need more major dental work and restorative treatments

- Risk factors: Smoking, diabetes, or other health conditions affecting oral health

- Budget considerations: Balance premium costs with potential treatment needs

- Geographic location: Ensure good provider networks in Melbourne CBD & Noble Park North

Compare Coverage Details

- Annual benefit limits: Ensure they match your expected treatment costs

- Coverage percentages: Higher percentages mean lower out-of-pocket costs

- Waiting periods: Shorter waiting periods provide faster access to benefits

- Pre-existing conditions: Some providers offer better coverage for existing issues

- Emergency coverage: Immediate coverage for dental accidents and emergencies

- Treatment categories: Ensure all needed treatments are covered

Provider Network Considerations

- Preferred dentists: Check if your current dentist is in the network

- Location convenience: Ensure network dentists are accessible in Melbourne CBD & Noble Park North

- No-gap or reduced-gap options: Some networks offer minimal out-of-pocket costs

- Emergency services: 24/7 dental emergency helplines and coverage

- Specialist access: Network includes orthodontists, oral surgeons, and other specialists

- Quality standards: Network providers meet specific qualifications and standards

Understanding Waiting Periods and Pre-Existing Conditions

Waiting periods are one of the most important aspects of dental insurance to understand. They can significantly impact when you can access benefits and how much you’ll pay out-of-pocket:

Standard Waiting Period Structure

- Immediate coverage (0 months): Preventive care like check-ups, cleaning, and routine x-rays

- 2-6 month waiting periods: Basic treatments like fillings, simple extractions, and basic gum treatment

- 6-12 month waiting periods: Major treatments like crowns, bridges, dentures, and root canals

- 12-24 month waiting periods: Orthodontics and pre-existing condition treatments

- Emergency exceptions: Accident-related treatments may be covered immediately

Pre-Existing Conditions

Pre-existing conditions are dental problems that exist before you take out insurance. Here’s what you need to know:

- Definition: Any dental condition diagnosed or requiring treatment before policy commencement

- Waiting periods: Usually 12 months before coverage begins for pre-existing conditions

- Disclosure: Must be declared honestly during application process

- Exclusions: Some policies may permanently exclude certain pre-existing conditions

- Documentation: May require dental records or examinations to verify conditions

Tips for Managing Waiting Periods

- Start early: Apply for dental insurance before you need treatment

- Emergency provisions: Some providers offer limited emergency coverage during waiting periods

- Continuous coverage: Switching providers may reset waiting periods

- Preventive focus: Use immediate preventive benefits to maintain oral health

- Treatment planning: Work with your dentist to plan treatments around waiting periods

MAXIMIZING YOUR DENTAL INSURANCE BENEFITS

Getting the most value from your dental insurance requires strategic planning and understanding how to navigate the system effectively. Here are proven strategies to maximize your benefits and minimize out-of-pocket costs:

Strategic Timing of Dental Treatments

Timing your dental treatments strategically can significantly impact your costs and coverage. Consider these approaches:

Annual Benefit Planning

- Use it or lose it: Most annual limits reset each year, so plan treatments accordingly

- Split major work: Divide expensive treatments across two benefit years to maximize coverage

- December timing: Complete preventive care before year-end to maximize benefits

- January start: Begin major treatments early in the year to access full annual limits

- Treatment sequencing: Plan multiple treatments to optimize benefit usage

- Family coordination: Coordinate family member treatments to maximize household benefits

Waiting Period Management

- Preventive care first: Start with immediate-coverage treatments to maintain oral health

- Treatment sequencing: Plan major work after waiting periods end

- Emergency planning: Understand what emergency coverage is available during waiting periods

- Multiple policies: Consider family coverage timing for different members

- Interim treatments: Use temporary solutions during waiting periods when necessary

Understanding Provider Networks and No-Gap Dentistry

Provider networks can significantly impact your out-of-pocket costs. Understanding how they work helps you save money while receiving quality care:

Preferred Provider Networks

- Network dentists: Providers who have agreements with your insurance company

- Fee schedules: Pre-negotiated rates often lower than standard fees

- Direct billing: Many network providers bill insurance directly, reducing upfront costs

- Quality assurance: Network dentists meet specific standards and qualifications

- Streamlined claims: Faster processing and fewer administrative hassles

- Guaranteed acceptance: Network providers accept your insurance without question

No-Gap and Reduced-Gap Options

- No-gap preventive care: Check-ups and cleanings with zero out-of-pocket costs

- Reduced-gap treatments: Lower costs for basic dental procedures

- Annual limits: No-gap benefits often have separate annual limits

- Eligibility requirements: May require minimum coverage levels or waiting periods

- Network participation: Usually only available with preferred provider networks

- Treatment limitations: May not apply to all procedures or complex treatments

Confused About Your Dental Insurance Options?

Our team at Melbourne CBD & Noble Park North can help you understand your insurance benefits and maximize your coverage. We work with all major Australian dental insurance providers.

???? Call for a consultation: 9629-7664 | 0413 014 122

???? View Our Special Packages

???? See Before/After Gallery

Common Dental Insurance Mistakes to Avoid

Avoiding these common mistakes can save you money and ensure you get the coverage you need. Learn from these frequent errors made by dental insurance holders:

Policy Selection Mistakes

- Choosing based on price alone: Cheapest policies often have the most limitations and exclusions

- Ignoring annual limits: Low limits may not cover your actual dental needs

- Overlooking waiting periods: Not accounting for how long before you can claim benefits

- Missing orthodontic needs: Not including orthodontic coverage when needed for family

- Inadequate coverage levels: Choosing basic coverage when comprehensive is needed

- Not reading fine print: Missing important exclusions and limitations

Claims and Coverage Mistakes

- Not understanding coverage percentages: Assuming everything is covered at 100%

- Going out-of-network unnecessarily: Paying higher costs when network options available

- Not getting pre-approvals: Missing opportunities for pre-treatment cost estimates

- Delaying necessary treatments: Allowing small problems to become expensive major issues

- Missing claim deadlines: Not submitting claims within required timeframes

- Incomplete documentation: Failing to provide necessary receipts and treatment details

Administrative Mistakes

- Letting policies lapse: Losing coverage and having to restart waiting periods

- Not updating coverage: Failing to adjust coverage as family needs change

- Missing claim deadlines: Not submitting claims within required timeframes

- Inadequate record keeping: Not maintaining proper documentation for claims

- Not comparing providers: Staying with inadequate coverage out of habit

- Ignoring policy changes: Not reading annual policy updates and changes

Dental Insurance for Different Life Stages

Your dental insurance needs change throughout your life. Understanding these changes helps you select appropriate coverage for each life stage:

Young Adults (18-30)

- Basic coverage focus: Preventive care and basic treatments usually sufficient

- Orthodontic consideration: If wisdom teeth or alignment issues need addressing

- Budget consciousness: Lower-cost policies with essential coverage

- Establishment phase: Building good oral hygiene habits and regular check-ups

- Emergency coverage: Important for sports injuries and accidents common in this age group

- Career considerations: Employer-provided coverage may become available

Families with Children (30-50)

- Family coverage: Policies covering multiple family members with age-appropriate benefits

- Orthodontic coverage: Essential for children’s braces and alignment treatments

- Preventive emphasis: Regular check-ups and cleanings for all family members

- Emergency provisions: Coverage for children’s dental accidents and injuries

- Budget planning: Higher annual limits to cover multiple family member needs

- School dental programs: Understanding how insurance works with school-based care

Mature Adults (50-65)

- Increased major work: Higher likelihood of needing crowns, bridges, and restorative work

- Gum disease focus: Periodontal treatments become more important with age

- Comprehensive coverage: Higher annual limits for anticipated major treatments

- Specialist care: Access to periodontists, endodontists, and oral surgeons

- Medication considerations: Some medications affect oral health, requiring more care

- Retirement planning: Considering coverage options after employer insurance ends

Seniors (65+)

- Major restorative needs: Dentures, implants, and extensive restorative work

- Health condition impacts: Diabetes, heart disease, and other conditions affecting oral health

- Medication effects: Dry mouth and other medication side effects requiring extra care

- Fixed income considerations: Balancing coverage needs with budget constraints

- Regular maintenance: More frequent check-ups and cleanings may be necessary

- Emergency coverage: Important for urgent dental issues that can’t wait

The Claims Process: Step-by-Step Guide

Understanding how to properly submit claims ensures you receive maximum benefits and avoid delays. Here’s a comprehensive guide to the claims process:

Before Treatment

- Verify coverage: Confirm your treatment is covered under your policy

- Check annual limits: Ensure you haven’t exceeded your annual benefit limit

- Get pre-approval: For major treatments, obtain pre-approval from your insurer

- Understand costs: Get treatment estimates and understand your out-of-pocket costs

- Choose providers: Select in-network dentists when possible for better coverage

- Schedule appropriately: Plan treatments to maximize annual benefits

During Treatment

- Collect documentation: Ensure you receive detailed receipts and treatment records

- Verify item numbers: Check that correct dental item numbers are used for billing

- Ask questions: Clarify any treatment details you don’t understand

- Request estimates: Get written estimates for multi-stage treatments

- Direct billing: Ask if your dentist offers direct billing to your insurer

- Keep records: Maintain copies of all treatment documentation

After Treatment

- Submit claims promptly: Don’t delay claim submission beyond deadlines

- Include all documentation: Provide receipts, treatment details, and any required forms

- Follow up: Track claim status and follow up if processing is delayed

- Review payments: Check that reimbursements match your policy coverage

- Appeal if necessary: Challenge denied claims if you believe they should be covered

- Update records: Track your annual benefit usage for planning future treatments

Expert Dental Care That Works With Your Insurance

At our Melbourne CBD & Noble Park North locations, we help patients navigate insurance claims and maximize their benefits. Our experienced team works with all major Australian dental insurance providers.

???? Schedule your consultation: 9629-7664 | 0413 014 122

???? Easy Online Booking

???? Free Consultation Available

Alternative Options to Traditional Dental Insurance

While traditional dental insurance is the most common option, several alternatives can help you manage dental costs effectively:

Dental Savings Plans

- Membership programs: Pay annual fee for discounted dental services

- No waiting periods: Immediate access to discounted rates

- No annual limits: Use as much as needed without benefit caps

- Provider networks: Access to participating dentists with preset discount rates

- Predictable costs: Know exactly what you’ll pay for each treatment

- Family options: Cover entire family with single membership fee

Payment Plans and Financing

- Interest-free periods: Many dental practices offer short-term interest-free payment plans

- Medical credit cards: Specialized credit cards for healthcare expenses

- Personal loans: Traditional loans for major dental work

- Practice financing: In-house payment plans offered by dental practices

- Government assistance: Low-income dental programs and subsidies

- Charitable programs: Non-profit organizations providing dental care assistance

Self-Insurance Strategies

- Dental savings accounts: Set aside money specifically for dental expenses

- Emergency funds: Maintain savings specifically for unexpected dental costs

- Preventive investment: Focus spending on preventive care to avoid major costs

- Employer benefits: Health savings accounts or flexible spending accounts

- Tax advantages: Medical expense deductions for significant dental costs

- Budget planning: Regular savings plans to cover anticipated dental needs

FREQUENTLY ASKED QUESTIONS ABOUT DENTAL INSURANCE

What does dental insurance typically cover in Australia?

Australian dental insurance typically covers preventive care at 100%, basic treatments at 70-100%, and major dental work at 50-80%. Coverage includes check-ups, cleanings, fillings, crowns, and sometimes orthodontics, subject to annual limits and waiting periods.

How long are waiting periods for dental insurance?

Waiting periods vary by treatment type: no wait for preventive care, 2-6 months for basic treatments, 6-12 months for major dental work, and 12-24 months for orthodontics and pre-existing conditions. Emergency treatments may have immediate coverage.

Can I choose any dentist with dental insurance?

Most Australian dental insurance allows you to choose any licensed dentist, but using preferred network providers often reduces out-of-pocket costs. Some policies require network dentists for no-gap benefits or maximum coverage levels.

What are annual benefit limits and how do they work?

Annual benefit limits are the maximum amount your insurer pays per person each year, typically ranging from $500-$2,500. Once reached, you pay all additional costs until the limit resets the following year. Choose limits based on your expected dental needs.

Is orthodontic treatment covered by dental insurance?

Orthodontic coverage is available but often requires higher-tier policies with separate annual limits and extended waiting periods of 12-24 months. Coverage typically includes braces, Invisalign, and retainers at 50-70% of costs after waiting periods.

Do I need to declare pre-existing dental conditions?

Yes, you must honestly declare any existing dental problems during application. Pre-existing conditions typically have 12-month waiting periods before coverage begins, and some policies may permanently exclude certain conditions. False declarations can void your policy.

How much does dental insurance cost in Australia?

Dental insurance costs vary widely: basic coverage $19-40/month, comprehensive coverage $37-70/month, and top-tier coverage $68-130/month. Costs depend on coverage level, annual limits, provider networks, and additional benefits included.

What happens if I switch dental insurance providers?

Switching providers may reset waiting periods for new coverage, meaning you could lose access to benefits temporarily. However, some providers offer reduced waiting periods if you maintain continuous coverage. Compare carefully before switching to avoid gaps in coverage.

Are cosmetic dental treatments covered by insurance?

Most cosmetic treatments like teeth whitening and veneers are not covered by standard dental insurance as they’re considered elective procedures. However, some treatments that improve function as well as appearance may have partial coverage.

How do I claim dental insurance benefits?

Claims can be submitted online, by phone, or mail with receipts and treatment details. Many network dentists offer direct billing, where they claim directly from your insurer. Keep all documentation and submit claims promptly to avoid delays or denials.

Can I get immediate dental coverage for emergencies?

Most dental insurance provides immediate coverage for accident-related dental injuries, but not for emergency treatments due to pre-existing conditions or neglect. Some providers offer limited emergency benefits during waiting periods for genuine accidents.

What documentation do I need for dental insurance claims?

Required documentation typically includes detailed receipts showing treatment dates, procedures performed, item numbers used, and total costs. Some claims may require treatment plans, x-rays, or pre-approval documentation. Keep copies of all dental records for your files.

CONCLUSION: MAKING THE RIGHT DENTAL INSURANCE DECISION

Choosing the right dental insurance in Australia requires careful consideration of your individual needs, budget, and oral health goals. Whether you’re in Melbourne CBD & Noble Park North or anywhere across Australia, the key is understanding your options and making informed decisions.

Remember that dental insurance is an investment in your long-term oral health and financial security. The cost of insurance premiums is typically much less than the potential cost of major dental treatments without coverage. By choosing appropriate coverage, maintaining good oral hygiene, and using your benefits strategically, you can ensure excellent dental care while managing costs effectively.

Key Takeaways:

- Start with preventive care to maximize immediate benefits

- Choose annual limits that match your expected dental needs

- Understand waiting periods and plan treatments accordingly

- Use provider networks to minimize out-of-pocket costs

- Keep detailed records and submit claims promptly

- Review and update your coverage as your needs change

This comprehensive guide to dental insurance in Australia provides the essential information you need to make informed decisions about your oral health coverage. Remember to consult with dental professionals and insurance providers to determine the best options for your specific situation and location, whether in Melbourne CBD & Noble Park North or elsewhere in Australia.

✨ Ready to begin your journey toward a healthier, more confident smile?

✨ At Vogue Smiles Melbourne, we see your smile as a lifelong investment—and we’re here to make it healthy, confident, and truly unforgettable.

Your comfort and confidence matter. Whether you’re after a simple check-up or a complete smile makeover, our caring team in Melbourne CBD & Noble Park North is here to help. Don’t wait until pain or insecurity grows—explore your options now.

Affordable. Gentle. Life-changing.

Book your FREE consultation and discover how our expert care and flexible payment plans can help you smile with pride.

Your Healthier Smile Starts Here – Book a Consultation

???? Call (03) 9629 7664 | 0413 014 122

REQUEST AN ONLINE PERSONALIZED QUOTE ➤

REQUEST FOR A FREE TELECONSULTATION ➤

Disclaimer:

The information on this website is for information purposes only. Is not a substitute for a proper professional care and advice. Each patient’s outcomes, risks, potential complications, and recovery differ. Any dental procedure, minor or major, carries risks, some minor and some serious. Before and after images seen on our Social Media and website pages are our actual patient and have been published/posted with our patients’ permission. All of our patients photos are subject to Copyrights protection. We are strong believers in responsible aesthetics. Every cosmetic, medical, or dental procedure comes with its own set of risks and benefits. Cosmetic Dentistry results will vary from patient to patient. Call our office and book for an actual in-office consultation for us to assess if you are a good candidate for a particular treatment. All of our Specials and packages posted on this site are subject to terms, conditions and availability. The exact fee for a particular cosmetic procedure will be determined after a preliminary assessment distinguishing your unique personal needs and the type of work needed. The prices mentioned on any of our website as well as any mentioned payment plan by a third party source, are just a guide and is subject to change. Call the third party financing providers or visit their website for more info. Please call the office on 9629-7664 for further queries or clarification.