Key Highlights:

✨ Longer-term, low-interest dental loans (e.g., TLC with up to 7 years at ~7.99% p.a.) offer significantly lower monthly repayments, reducing financial stress for patients.

✨ Patients have the flexibility to make extra repayments or pay off the loan early without penalties, making these loans adaptable to changing financial situations.✨ TLC and similar providers do not charge merchant fees to dentists, ensuring practitioners receive full treatment payment upfront.

✨ Interest-free providers (e.g., Denticare, Humm, Zip) often charge merchant fees (4–8%), which may be silently added to patients’ final bills.

✨ Some providers like Denticare pay dentists in installments over months or years, which can create negative cash flow for clinics, especially for costly treatments with high upfront lab and material fees.

✨ Interest-free plans are better suited for small or short-term treatments, while low-interest, long-term loans are ideal for extensive smile makeovers or full-mouth rehab.

✨ Choosing the right financing option benefits both patients (affordable, manageable repayments) and dentists (better cash flow and financial stability).

📞 Call Vogue Smiles Melbourne and Noble Park today for a comprehensive general and smile makeover treatment — offering competitive pricing, bundled porcelain veneer specials, interest-free dental plans, and Superannuation access assistance.

How to Finance Your Smile Makeover Without Breaking the Bank

A confident smile can be life-changing. However, the cost of cosmetic dentistry can often be a barrier to those dreaming of transforming their smile. If you reside in Noble Park North or surrounding suburbs and are wondering how to finance your smile makeover without breaking the bank, this comprehensive guide will explore a wide range of solutions. From third-party financing options and personal loans to superannuation access and strategic treatment staging — you’ll find multiple ways to make your smile goals financially achievable.

In this guide, we’ll cover:

- Third-party dental financing companies in Australia

- Interest-free vs low-interest dental loans

- Eligibility criteria and how to increase approval chances

- Accessing superannuation for dental procedures

- Using personal loans, credit cards, and home equity

- Borrowing from family or friends

- Staging your smile makeover treatment for affordability

- Alternatives to premium cosmetic procedures

Let’s explore each of these pathways in detail.

Choosing the Right Dental Financing: Interest-Free vs Low-Interest Long-Term Loans

When it comes to funding your smile makeover, one of the most crucial decisions patients face is whether to opt for an interest-free, short-term dental loan, or a low-interest, long-term financing plan. While the idea of paying no interest is appealing, it’s important to look beyond the surface. In many cases, a longer-term, low-interest loan can actually be more affordable and less stressful in the long run — particularly for larger, full-mouth cosmetic rehabilitation cases.

Let’s take TLC (Total Lifestyle Credit) as an example. TLC offers dental loans with terms stretching up to 84 months (7 years), with competitive low interest rates starting from around 7.99% p.a.. The biggest benefit? Because the repayment is spread across many months or even years, monthly repayments can be significantly lower, making the treatment more accessible. Instead of being pressured to pay $2,000–$3,000 every month with a short-term plan, you might only pay $100–$300 per month, depending on your total loan amount and term. This is a realistic option for families or individuals managing everyday expenses, mortgages, or other financial obligations.

Another advantage of companies like TLC is the flexibility to make extra repayments or even pay off the loan in full early — without penalty. If your financial situation improves or you receive a tax return or bonus, you can top up your repayments or settle the entire balance. This combination of flexibility and lower monthly strain is what makes low-interest financing a smart choice for many patients, particularly for procedures like full veneers, dental implants, or complete smile transformations that can cost upwards of $15,000–$30,000.

From the dental clinic’s perspective, long-term low-interest providers like TLC are also attractive because they do not charge a merchant fee. This means the dentist receives the full treatment amount upfront, without deductions. This is in contrast to interest-free providers like Humm, Zip, or Denticare, which often charge the dentist a merchant fee — typically ranging from 4% to 8% of the total cost. While patients might not see this fee directly, it is often silently added to their treatment quote, making their total bill higher than expected.

Furthermore, with providers like Denticare, the dental practitioner receives payments on a monthly installment basis — sometimes over a 12- to 24-month period. This model can place a strain on clinics, especially for high-cost treatments that require upfront expenses such as dental laboratory work, materials, and specialist fees. If the full treatment cost is not received immediately, the dentist essentially operates at a negative cash flow, which may affect their willingness or ability to offer discounted or value-added packages.

In summary, while interest-free payment plans can be useful for minor treatments or short-term needs, low-interest, long-term dental financing plans are often more sustainable and financially beneficial for both the patient and the practitioner — especially for large, life-changing smile makeover procedures.

Third-Party Dental Financing Companies in Australia

One of the most popular ways to finance a cosmetic dental makeover is through dental-specific financing companies. These businesses offer payment plans tailored to patients seeking aesthetic treatments like porcelain veneers, Invisalign, teeth whitening, and more.

Top Providers in Australia:

a) TLC (Total Lifestyle Credit)

Website: https://tlc.com.au

- Loan range: Up to $50,000

- Terms: Up to 84 months (7 years)

- Interest: From 7.99% p.a.

- Eligibility: Employed or self-employed applicants with a stable income

- Specialty: Covers all types of healthcare, including cosmetic dental

- Pros: Fast pre-approval, flexible terms

- Cons: Charges interest, comparison rate may vary

b) Denticare Payment Plans

Website: https://www.denti-care.com.au

- Loan range: Up to $12,000

- Interest: 0% interest plans available through participating dentists

- Eligibility: Requires employment and ID check

- Pros: No interest, payment spread over 3–24 months

- Cons: Must go through a partnered clinic, upfront setup fee may apply

c) Humm (formerly Certegy)

Website: https://www.shophumm.com.au

- Loan range: Small (up to $2,000) and Big things (up to $30,000)

- Interest: 0% for eligible plans; fees apply

- Pros: Instant approval, no interest if paid on time

- Cons: Late payment fees, approval may depend on credit rating

d) Zip Money & Zip Pay

Website: https://zip.co

- Loan range: Up to $10,000

- Interest: 0% interest for short-term periods; then up to 19.9% p.a.

- Pros: Fast setup, integrated into some dental clinics

- Cons: Interest applies if not paid in the interest-free period

e) Afterpay Health

Website: https://www.afterpay.com.au/categories/health

- Limit: Up to $2,000

- Interest: None if payments are made on time

- Pros: No interest, weekly or fortnightly repayments

- Cons: Best for small cosmetic procedures only

Interest-free vs low-interest dental loans

The key difference between these options lies in the duration and amount borrowed:

- Interest-Free Loans: Ideal for smaller treatments or if you can repay the amount within 6–24 months.

- Example: Denticare or Humm’s small loans

- Low-Interest Loans: More suitable for full smile makeovers (e.g., veneers for 10–20 teeth)

- Example: TLC or Zip Money with 6–7 years repayment plans

Pros of Interest-Free Loans:

- No added cost if paid on time

- Easier to manage weekly/fortnightly payments

Cons:

- Short repayment window

- Penalties for missed or late payments

Pros of Low-Interest Loans:

- Higher borrowing limit

- Longer payment flexibility

Cons:

- Higher total repayment amount due to interest over time

| Financing Option | Interest Rate | Max Loan Amount | Key Features |

|---|---|---|---|

| TLC | From 7.99% | $50,000 | Flexible terms, all procedures covered |

| Denticare | 0% (through clinics) | $12,000 | Clinic-based, no interest |

| Humm | 0% (eligible users) | $30,000 | Fast approval, short terms |

| Zip Money | 0%–19.9% | $10,000 | Long-term options |

| Afterpay Health | 0% (on-time) | $2,000 | Short-term, simple cosmetic work |

Eligibility Criteria and How to Increase Approval Chances

Dental finance providers have their own unique assessment criteria, but most look at a combination of the following:

- Stable employment or self-employment income

- Minimum income threshold (usually $25k–$30k/year)

- Good credit score/history

- Valid Australian ID and address

Tips to Improve Approval Odds:

- Reduce existing credit card debt

- Avoid applying for multiple loans simultaneously

- Use a co-signer if possible

- Provide complete and accurate documentation

Accessing Your Superannuation for Dental Treatments in Australia: Timeline, Process & Patient Experience

If you’re experiencing serious dental issues that affect your quality of life, you may be eligible to access your superannuation early on compassionate grounds.

Using your superannuation to fund essential dental treatment is becoming an increasingly viable option for Australians facing urgent or complex oral health issues. While earlier we covered the eligibility requirements and third-party facilitators like Access My Super and SuperCare, this section dives deeper into the timeline for application, release of funds, and practical tips to avoid delays — all of which are crucial for patients planning a smile makeover without financial strain

How Long Does the Super Access Process Take?

From start to finish, the typical timeline for superannuation early release for dental treatment ranges between 2 to 6 weeks, depending on whether you apply independently or through a facilitator. Here’s a detailed breakdown:

1. Document Collection Stage – 3 to 7 Days

The first and often most underestimated part of the process is gathering all the required documents:

-

A formal treatment plan from your dentist with cost breakdown

-

Supporting medical reports (from a GP or dental specialist)

-

Evidence of financial hardship (e.g., income proof, overdue bills)

Many delays happen here because patients often:

-

Don’t understand the ATO’s expectations for medical documents

-

Miss key signatures from dental providers

-

Provide vague or incomplete financial statements

Tip: Work closely with your dental clinic or a third-party provider to ensure all paperwork is clear, correctly formatted, and compliant with ATO guidelines.

2. Application Submission via MyGov – 1 to 2 Days

Once all documents are in order, you can submit your application through your MyGov account under the Australian Taxation Office (ATO) portal. This step is quick — usually taking under 24 hours — and involves uploading documents, filling out compassionate release forms, and confirming personal information.

If you’re using a third-party facilitator like SuperCare or Access My Super, they typically submit this on your behalf once your case file is complete.

3. ATO Assessment & Approval – 7 to 14 Business Days

This is the most crucial step. Once submitted, the ATO reviews your application to determine whether your case qualifies for early release under compassionate grounds (specifically for “alleviating acute or chronic dental pain”).

You’ll usually receive notification of the outcome within 7–14 business days, depending on the complexity of your case and the volume of applications being processed.

-

Fast-track cases may be approved in under 5 business days if all paperwork is perfectly in order.

-

Complex or borderline cases may take longer or even be rejected if documents lack detail or clarity.

4. Payment from Superannuation Fund – 3 to 10 Business Days

Once the ATO approves the application, a determination letter is sent both to you and your nominated superannuation fund. It then becomes the fund’s responsibility to release the approved amount.

-

Industry super funds like AustralianSuper or Hostplus generally disburse funds within 3–5 business days

-

Retail funds like AMP, MLC, or Colonial First State can take up to 10 business days

-

Self-managed super funds (SMSF) may require trustee action, which can delay things if not promptly handled

Important: Some super funds may request additional verification or banking information before transferring money, adding another 1–2 days.

Realistic Timeline Summary:

-

Minimum Timeframe (With all documents ready and a facilitator): 10 business days (2 weeks)

-

Average Timeframe: 3 to 4 weeks

-

Longer Timeframe (with rework or rejections): Up to 6 weeks

Fast-Tracking Your Application: Tips for Speedy Approval

Here are actionable ways to avoid delays and increase the likelihood of faster approval:

-

Use a template letter from your dentist – The ATO has specific language expectations; experienced clinics will know what to include.

-

Ensure GP letters clearly state medical necessity – Vague language like “patient needs dental work” won’t suffice.

-

Submit bank account verification to your super fund early – Some funds require it to release money.

-

Avoid sending screenshots – Always attach clear PDFs for bills and identification documents.

-

Double-check all signatures and clinic provider numbers – Missing details result in rejection.

What Happens After You Receive the Funds?

Once the superannuation payment is deposited into your account:

-

You can immediately pay the dentist, who may ask for full or partial payment depending on your treatment stage

-

Some dentists require a deposit upon scheduling, while others proceed only after full funds are cleared

-

Many clinics working with super-funded patients allow treatment to start upon ATO approval (not waiting for payment), especially if coordinated with SuperCare or Access My Super

What If Your Super Application Gets Rejected?

Unfortunately, rejections do happen. The most common reasons include:

-

Inadequate or non-specific medical documentation

-

Lack of financial hardship evidence

-

Application submitted for cosmetic reasons only, without pain or function impairment justification

How to Appeal or Reapply:

-

Review the rejection reason in the MyGov portal

-

Ask your GP or dentist to revise letters with greater medical detail

-

Gather updated bills or income evidence

-

Resubmit a fresh application (there’s no limit, but constant reapplication without changes may weaken your case)

Private Super Funds and Self-Managed Super Funds (SMSF): Special Notes

Patients with SMSFs or private retail super funds may face additional hurdles:

-

SMSFs: You (as trustee) must approve and document the release, often requiring legal or financial advice. You must also report it to the ATO properly.

-

Retail funds: May request original certified copies or additional paperwork beyond what ATO requires.

Tip: Always contact your fund in parallel with the ATO application to avoid surprises.

Why Super Access Works So Well for Smile Makeovers

Smile makeover procedures — especially full mouth reconstructions with veneers, implants, or crowns — often exceed $10,000–$30,000. For patients who:

-

Are not eligible for third-party loans

-

Don’t have adequate savings or credit

-

Are in pain or socially withdrawn due to dental appearance

… super access can be a life-changing bridge to receive necessary treatment now rather than wait indefinitely.

Eligibility Criteria from ATO:

You must demonstrate:

- Severe or chronic dental pain

- Financial difficulty in affording urgent treatment

- A formal treatment plan and cost from a registered dentist

How to Apply Successfully:

- Gather supporting documents: treatment plan, medical/dental letters

- Apply via MyGov through the ATO

- Wait for approval before starting treatment

Third-Party Companies That Assist:

Access My Super

Website: https://accessmysuper.com.au

- Service: Handles your ATO application and paperwork

- Fee: Around $699–$899 depending on complexity

- Pros: Expert guidance, increases approval success

- Cons: Added cost

SuperCare Dental & Medical

Website: https://mysupercare.com.au

- Service: ATO submission support, document coordination

- Fee: Typically $660–$880

- Pros: High success rate, good for families or urgent cases

- Cons: Non-refundable fee

Many patients find these services worth the investment, especially if they feel overwhelmed by the paperwork.

Personal Loans, Credit Cards, and Home Equity

Outside of dental-specific finance options, some patients prefer to fund their smile makeover through personal credit avenues:

Personal Loans (via Banks or Online Lenders):

- Can range from $5,000–$50,000

- Interest rates between 7% and 15% p.a.

- Best for those with strong credit history

Credit Cards:

- Suitable for smaller procedures

- May offer 0% balance transfer offers

- Risk of high interest if not repaid promptly

Home Equity Redraw or Mortgage Top-Up:

- If you have equity in your home, you may redraw funds or refinance

- Lower interest rates than personal loans

- Must factor in longer-term repayments

Always consult a financial advisor before borrowing against your property.

Borrowing from Family or Friends

In some situations, patients may turn to trusted loved ones to finance their cosmetic dental journey. While this can be a viable option, it’s important to:

- Set clear repayment expectations

- Put agreements in writing to avoid misunderstandings

- Consider interest-free or low-interest repayment schedules

This approach can preserve your credit score and eliminate interest fees, but should be handled professionally.

Staging Your Smile Makeover to Reduce Costs

You don’t have to complete your entire dental transformation all at once. Many dentists, especially in the Noble Park North area, can create a phased treatment plan that allows you to:

- Focus on the most visible teeth first (e.g., 4–6 upper front veneers)

- Spread out appointments over months or even years

- Combine cosmetic and restorative elements gradually

This not only makes your investment manageable but also gives you flexibility to adjust or expand your treatment as budget allows.

Cost-Saving Alternatives to Premium Veneers or Cosmetic Procedures

If full-mouth porcelain veneers are out of your financial reach, consider more economical alternatives:

- Composite veneers: Cheaper but shorter lifespan

- Teeth whitening: Immediate cosmetic boost for under $500

- Dental bonding: Great for minor chips or reshaping

- Snap on Smile

- Transitional Smile makeover

Consult with us to create a treatment plan that aligns with your goals and your budget.

The Benefits of Choosing a Compromised Dental Treatment Over Waiting

When it comes to achieving your dream smile, the ideal scenario might be to complete a full, comprehensive smile makeover in one go with the best materials and techniques available. However, the reality for many patients is that ideal financing or budget availability can take time to arrange. Rather than postponing treatment indefinitely or avoiding it altogether, opting for a compromised or staged treatment plan can offer significant benefits — both practical and emotional.

Boost Your Confidence Sooner

One of the most immediate benefits of starting with a partial or simplified treatment is the confidence boost that comes from improving your smile now — even if it’s just a few teeth or less costly procedures initially. A beautiful smile has a powerful impact on how you feel about yourself and how others perceive you. Waiting for an unknown future to “save up” or secure perfect financing means delaying these life-changing benefits.

Avoid Further Dental Deterioration

Sometimes waiting can lead to worsening dental conditions. If you have chipped, cracked, or discolored teeth, or even missing teeth, delaying treatment can cause further damage or additional complications. Addressing urgent or visible concerns early, even if it’s not the complete makeover, can help protect your oral health and reduce long-term costs.

Flexibility and Financial Ease

Compromised treatment options often allow you to spread the investment over time, making payments more manageable. Instead of a large lump sum, starting with a smaller number of veneers or restorations reduces immediate financial pressure. You can then plan to complete the rest when your finances improve, making the process less stressful.

Psychological and Social Benefits

Smiling more freely can positively affect your social interactions, professional life, and mental wellbeing. When you feel good about your teeth, you’re more likely to engage confidently in conversations, smile in photos, and experience reduced self-consciousness in social settings. This boost in self-esteem can ripple across many aspects of life, from work opportunities to personal relationships.

Opportunity to Test Treatments

Starting with a limited treatment can also give you a chance to experience the dental work and evaluate how it fits your lifestyle, comfort, and aesthetic preferences. This “trial” can inform your decisions for future treatments, ensuring that when you proceed with the full makeover, it’s exactly right for you.

Avoid Regret and Delay-Related Stress

Postponing treatment because of financial uncertainty often leads to regret, stress, and decreased quality of life. Knowing you’ve taken a positive step towards your smile goals, even if it’s not the full plan yet, can relieve anxiety and give you motivation to continue improving your smile.

Choosing a compromised dental treatment is a proactive and practical approach that offers immediate benefits in confidence, oral health, and social wellbeing. Rather than waiting indefinitely for the perfect financial situation, improving your smile now — even on a smaller scale — helps you enjoy a better quality of life today. It’s a smart, flexible way to invest in yourself, with the option to enhance and complete your smile makeover in the future when circumstances allow.

In conclusion, if you’re seeking to finance your smile makeover in Noble Park North without financial strain, a variety of flexible, accessible options exist. From structured loans and super access to strategic staging and alternative procedures — achieving your dream smile is within reach with the right plan.

Begin Your Smile Transformation Today

Whether you’re preparing for a milestone event, stepping back into the professional world, or finally ready to smile with pride—there’s no better time to start your transformation. Let Vogue Smiles Melbourne help you reclaim the joy, confidence, and freedom that come with a radiant, worry-free smile.

Your dream smile is closer than you think. Trust your transformation to a dentist with over 3 decades of passion to Cosmetic Dentistry

Book Your Smile Makeover Consultation

📞 Call (03) 9629 7664 | 0413 014 122

REQUEST AN ONLINE PERSONALIZED QUOTE ➤

REQUEST FOR A FREE TELECONSULTATION ➤

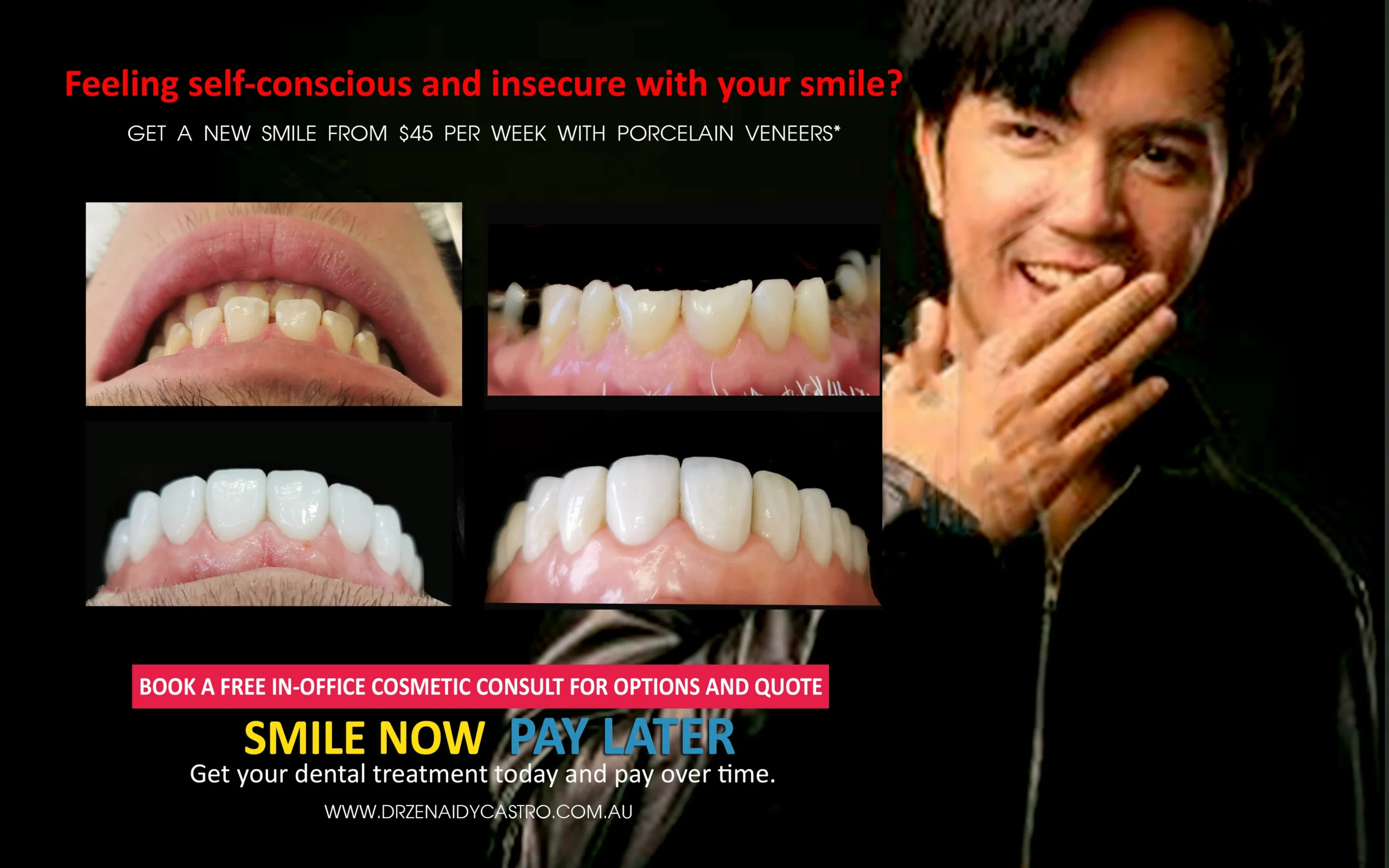

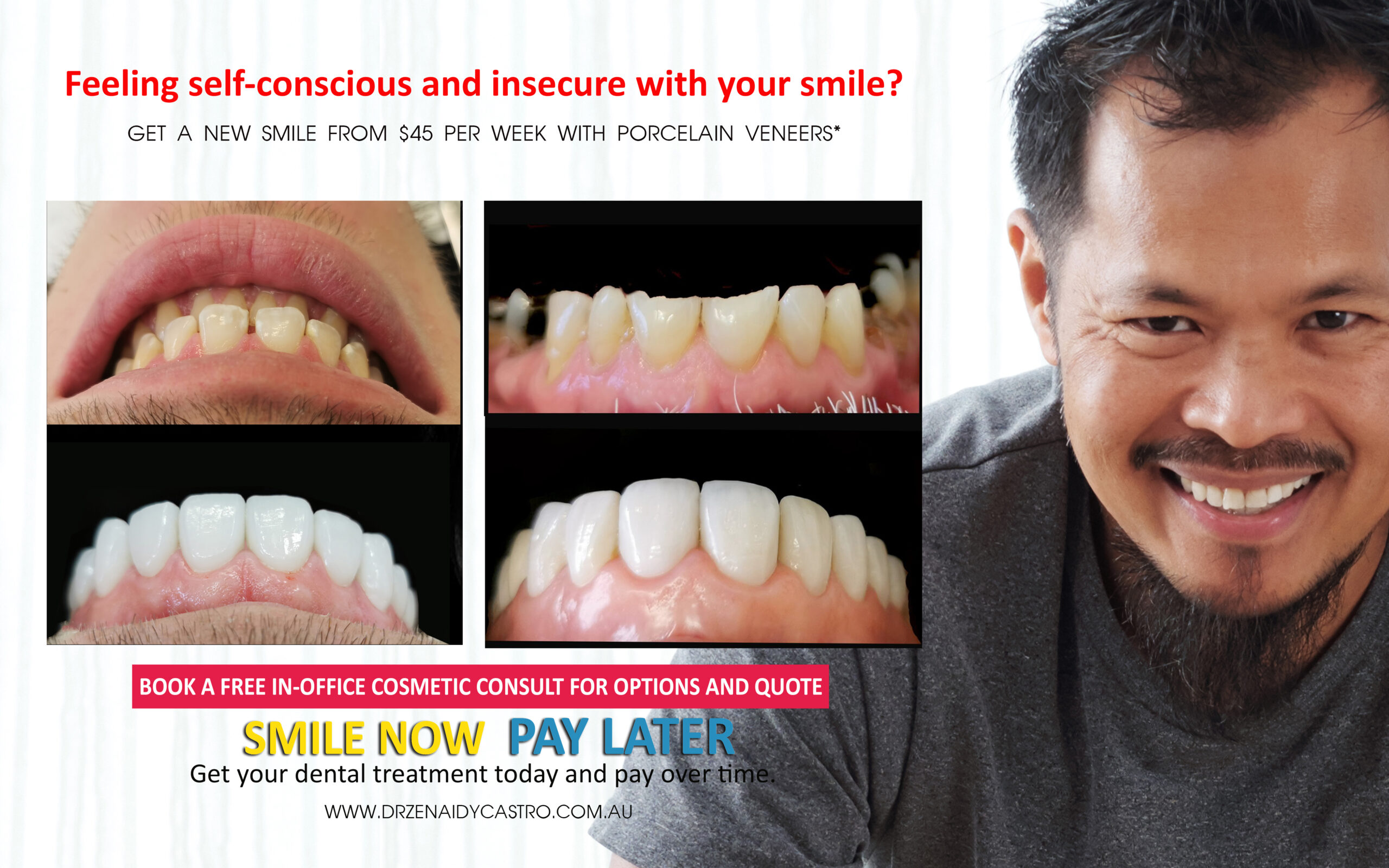

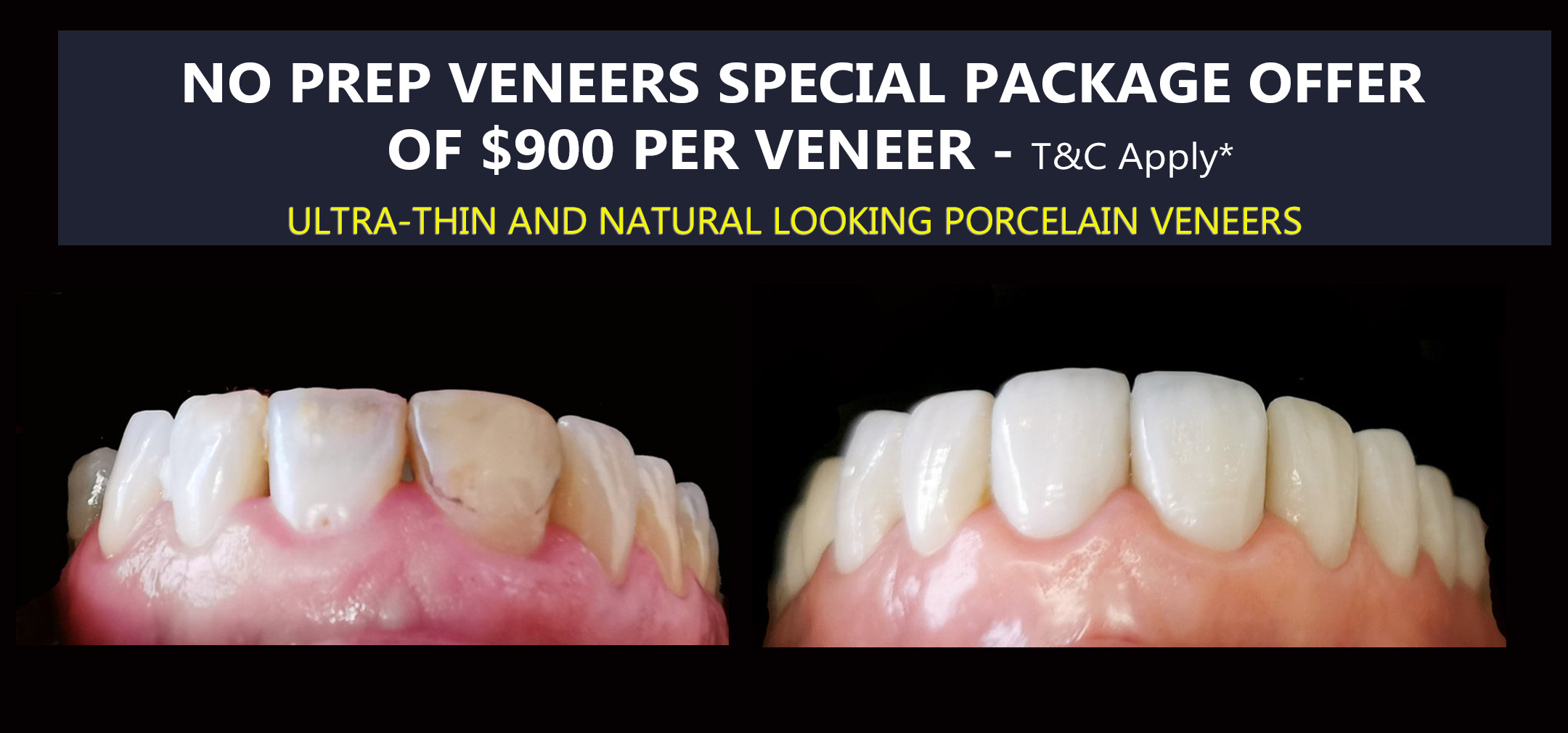

“See the Smiles We’ve Transformed — Yours Could Be Next!”

Transformations That Inspire — See Our Stunning Before & Afters

Make Your Dream Smile Affordable – Ask Us About Your Payment Options & Super Access Options

Transform Your Smile Without the Financial Stress! Explore easy, affordable options to fund your dream smile makeover — choose from interest-free dental financing or access your superannuation for dental treatment. Take the first step toward a confident new you —contact us today (03) 9629 7664 | 0413 014 122 for a free consultation! Alternatively, you can send us an email.

FIND OUT MORE:

Accessing your superannuation for dental treatment in Australia

Expenses eligible for release on compassionate grounds for Super Access

Get the treatment that you need with Dental Financing Offer of up to 4 years with TLC

Enquire to TLC Weekly or Monthly repayment Quote 1 300 045 047

Apply for TLC Dental Financing

Explore other Financing options and see if you are Eligible for dental finance

More Than a Dentist– Meet Dr. Zenaidy Castro, Artist and Visionary

Welcome to the world of Dr. Zenaidy Castro — a passionate and skilled cosmetic dentist who not only transforms smiles but also expresses beauty through fine art and photography. Beyond the dental chair, Dr. Castro is a visionary abstract artist and accomplished photographer, known for creating emotionally rich and visually stunning masterpieces. She is the founder of Heart & Soul Whisperer Art Gallery, an online gallery showcasing her unique artistic voice that blends emotion, color, and soul.

We invite you to explore her creative universe at Heart & Soul Whisperer Art Gallery and discover how her artistic spirit inspires everything she does — from designing beautiful smiles to capturing the beauty of life through her lens and canvas. Check Dr Castro’s curated Black and white Fine art Photographs

Disclaimer:

The information on this website is for information purposes only. Is not a substitute for a proper professional care and advice. Each patient’s outcomes, risks, potential complications, and recovery differ. Any dental procedure, minor or major, carries risks, some minor and some serious. Before and after images seen on our Social Media and website pages are our actual patient and have been published/posted with our patients’ permission. All of our patients photos are subject to Copyrights protection. We are strong believers in responsible aesthetics. Every cosmetic, medical, or dental procedure comes with its own set of risks and benefits. Cosmetic Dentistry results will vary from patient to patient. Call our office and book for an actual in-office consultation for us to assess if you are a good candidate for a particular treatment. All of our Specials and packages posted on this site are subject to terms, conditions and availability. The exact fee for a particular cosmetic procedure will be determined after a preliminary assessment distinguishing your unique personal needs and the type of work needed. The prices mentioned on any of our website as well as any mentioned payment plan by a third party source, are just a guide and is subject to change. Call the third party financing providers or visit their website for more info. Please call the office on 9629-7664 for further queries or clarification.