Key Highlights:

Basic Dental Care Costs in Tough Times: What to Know

The High Cost of Delaying Dental Care: Why Preventive Visits Are More Important Than Ever

In an age where every dollar counts and the rising cost of living affects nearly every aspect of daily life, it’s no surprise that many individuals and families are reevaluating their expenses. From groceries and fuel to rent and healthcare, inflation has made it harder to stretch each paycheck. Understandably, people look for areas where they can temporarily cut back—and sadly, dental care often ends up on that list.

When finances are tight, preventive and maintenance dental visits can seem less urgent. After all, if you’re not in pain, it may feel like skipping a check-up is harmless. But in truth, postponing routine dental care can lead to far more costly and complex problems in the future—both medically and financially.

Routine dental visits are not just about cleaning your teeth or polishing your smile. These appointments play a crucial role in detecting early signs of issues such as tooth decay, gum disease, enamel wear, and oral infections. Catching these problems early allows your dentist to treat them with minimally invasive, lower-cost procedures, such as fillings, fluoride treatments, or simple cleanings.

When regular care is postponed, small problems can grow silently into larger ones. A minor cavity that could have been treated for under $200 might evolve into an infected tooth requiring a root canal or extraction—costing upwards of $1,500 or more. Worse, untreated dental infections can spread and lead to severe health complications, including abscesses, bone loss, or even systemic illness.

Beyond the financial aspect, neglected oral health takes a toll on your overall well-being. Gum disease, for instance, has been linked to chronic conditions like heart disease, diabetes, and stroke. Persistent dental issues can also affect your ability to eat, speak, sleep, and feel confident—impacting your quality of life and emotional health.

At Vogue Smiles Melbourne, we understand the economic pressures many people are facing today. That’s why we offer affordable dental care options, flexible payment plans, and bundled services to help you stay on top of your oral health without overwhelming your budget. We firmly believe that cost should never be a barrier to care—and that prevention is always more affordable than correction.

We also encourage our patients to consider the long-term savings of regular check-ups. Think of it as protecting an investment—your smile. Preventive care is not just about saving money on treatments; it’s about preserving your health, your comfort, and your confidence for years to come.

So if you’ve been thinking about skipping your next dental appointment to save money, we urge you to reconsider. The small cost of regular care today could save you thousands tomorrow—not to mention the pain, time, and stress of more serious treatments down the track.

📞 Call us on 9629-7664 or 0413 014 122 to schedule your next appointment, and let us help you protect your smile—and your wallet.

This guide explores basic dental care costs, how to save money during economic hardship, and whether it’s wise to delay or proceed with dental treatments in tough financial times.

The True Cost of Basic Dental Care

Dental costs vary widely depending on your location, the clinic, and whether you have insurance. Below is a general estimate of out-of-pocket dental care costs in Australia (in AUD) for common procedures without insurance:

| Procedure | Average Cost (AUD) |

|---|---|

| Oral examination | $50 – $100 |

| Teeth cleaning (scale & polish) | $100 – $200 |

| Dental X-rays | $30 – $60 per image |

| Fluoride treatment | $30 – $60 |

| Simple fillings | $150 – $300 |

| Tooth extraction | $180 – $400 |

| Root canal treatment | $900 – $2,000 |

| Dental crown (porcelain) | $1,500 – $2,500 |

What Drives Dental Costs?

Several factors contribute to the cost of dental services:

-

Clinic location and overhead

-

Technology used (e.g., digital X-rays, CAD/CAM)

-

Materials (e.g., composite vs. ceramic)

-

Experience and expertise of the dentist

-

Lab fees and specialized procedures

Why Preventive Dental Care Still Matters in a Recession

Preventive care—including cleanings, check-ups, and minor treatments—helps avoid more severe dental issues. In tough economic times, skipping these can seem like a money-saving move, but this short-term decision may lead to costly emergencies later.

Here’s Why You Shouldn’t Delay Preventive Dental Work

✔️ Catch Issues Early: A small cavity caught early costs far less to fill than if it grows and requires a crown or root canal.

✔️ Avoid Painful Emergencies: Dental infections and abscesses often happen when care is neglected.

✔️ Prevent Tooth Loss: Gum disease is reversible early on. Delaying cleanings and checkups increases the risk of losing teeth—leading to costly replacements.

✔️ Lower Long-Term Costs: A $150 check-up twice a year could prevent a $3,000+ dental emergency.

How to Save on Dentistry During Hard Times

1. Focus on Preventive Care

Even in lean times, budget for bi-annual cleanings and check-ups. These are far less costly than restorative or surgical treatments.

💡 Tip: Ask your dentist if they offer a recall plan or package pricing for twice-a-year check-ups. Some clinics offer significant discounts when services are bundled.

2. Prioritize Urgent vs. Optional Treatments

When money is tight, prioritize dental procedures in this order:

| Priority | Procedure Type | Why |

|---|---|---|

| High | Infections, pain, fractures | Can escalate quickly |

| Medium | Small cavities, gum issues | Affordable now, worse later |

| Low | Whitening, cosmetic work | Purely aesthetic |

Ask your dentist to create a treatment priority plan so you can spread out costs logically.

3. Consider Public Dental Services (If Eligible)

Public dental clinics are available for concession cardholders and pensioners in Australia. They offer:

-

Free or low-cost check-ups

-

Reduced-cost fillings and extractions

-

Long wait times but affordable care

⚠️ Note: There may be eligibility restrictions and long waitlists, so plan ahead.

4. Use Dental Payment Plans or Financing

Many dental clinics now offer interest-free payment plans through companies like Afterpay, ZipMoney, or Humm. These allow you to:

-

Spread costs over months

-

Get urgent care now, pay later

-

Avoid large upfront fees

⚠️ Always read the fine print and be realistic about repayment schedules.

5. Shop Around for Dental Services

Not all dental clinics charge the same. Look for:

-

Community dental clinics

-

Dental schools (supervised students offer low-cost treatment)

-

New dental offices offering introductory discounts

-

Dentists with transparent fee schedules

💡 Pro Tip: Search online for clinics that publish their fees upfront—this reduces the chance of hidden costs.

6. Claim Private Health Insurance Benefits

If you have extras cover, use your benefits before they expire each year.

-

Most policies renew annually on Jan 1st or July 1st.

-

Many include 100% cover for basic check-ups and cleans.

-

You may also get partial cover for fillings or extractions.

Check:

-

Annual limits

-

Waiting periods

-

Preferred providers (no-gap benefits)

7. Use Health Savings Accounts (HSA) or Pre-Tax Options

If you operate a business or are self-employed, you may be able to claim some dental costs through your business depending on structure.

Check with an accountant whether:

-

Your health policy premiums or dental treatments are deductible

-

You qualify for a health savings plan

Should You Delay Dental Treatment in Tough Times?

Short Answer: Only if it’s low-priority or cosmetic.

If you’re experiencing economic stress, it’s understandable to reconsider your spending. But postponing essential or preventive dental care is often false economy. Let’s examine the risks.

Risks of Delaying Preventive Dental Work

-

Cavities grow and become root canals

-

Gum disease progresses to irreversible bone loss

-

Missing teeth cause jaw misalignment

-

Simple stains become embedded and harder to clean

-

Bad breath, discomfort, and social stigma increase

When It’s OK to Wait

Here are scenarios where delaying may be safe:

| Procedure | Safe to Delay? | Notes |

|---|---|---|

| Teeth whitening | ✅ | Cosmetic only |

| Small chips (no pain) | ✅ | Monitor for worsening |

| Dental implants (non-visible) | ✅ | Use temporary solutions |

| Orthodontics (minor correction) | ✅ | Purely aesthetic |

Always consult your dentist before deciding.

Smart Ways to Plan for Dental Costs in the Future

Create a Dental Emergency Fund

Set aside even $10–$20 a month in a health envelope. Over a year, that’s $120–$240—enough for a check-up or to offset a filling.

Leverage Telehealth and Online Consults

Some dental clinics offer virtual assessments for:

-

Minor issues

-

Cosmetic consultations

-

Treatment planning

This saves time and costs less than an in-person visit.

Questions to Ask Your Dentist in Tough Times

-

“Which treatments are absolutely necessary now?”

-

“Can I split treatments across months?”

-

“Do you offer a discount for paying upfront?”

-

“Is there a no-gap option with my insurance?”

-

“Do you have interest-free payment plans?”

Dentists are more understanding than you might think—just ask.

Understanding Dental Costs in Tough Economic Times

Living in Melbourne, particularly in suburbs like Noble Park North, patients often wonder why dental work costs what it does. Especially in financially challenging times, understanding how dental fees are calculated and what factors influence them is crucial. This guide aims to shed light on the true cost of dental care, how you can save money, and whether delaying preventative treatment is ever a wise option.

Why Dental Fees Vary in Melbourne

Dental treatment fees in Melbourne are not standardized. Each clinic sets its own prices based on a combination of:

- Skill and experience of the dentist

- Location of the clinic

- Technology and equipment used

- Complexity of each case

- Materials used (e.g., composite vs ceramic)

For instance, a simple filling might cost $120 at one clinic but $250 at another. Crowns can range from $1,200 to $2,500 depending on the lab work and materials involved.

Why It’s Hard to Quote Prices Over the Phone

Patients often inquire about costs over the phone. However, providing accurate pricing without seeing the patient is nearly impossible. Each case varies based on:

- Existing dental condition

- Treatment complexity

- Patient expectations

- Additional procedures required (e.g., gum treatment before veneers)

Thus, the best course of action is always to attend a consultation with a qualified dentist, such as Dr. Zenaidy Castro.

Smile Makeovers: How Much Do They Cost?

Smile makeovers can range from basic whitening to full mouth reconstruction, including:

- Veneers

- Dental crowns

- Dental implants

- Invisalign or braces

- Gum contouring

It’s like asking, “How much is a car?” — costs vary based on materials, techniques, and your desired level of perfection. The only way to get an accurate quote is by evaluating your dental health and aesthetic goals in person.

Beware of ‘Too-Good-To-Be-True’ Phone Quotes

Shopping around by phone for the lowest price can lead to disappointment. Some clinics might underquote just to get patients through the door. But once examined, the ‘real’ costs surface.

Over-the-phone quotes are:

- Not personalized

- Often don’t consider hidden complexities

- Can be misleading

Always prioritize getting a proper diagnosis and treatment plan to avoid surprise costs later.

Factors Influencing Cosmetic and General Dentistry Costs

Costs are influenced by many factors, such as:

- Current condition of your teeth and gums

- Type of materials used (composite, porcelain, gold)

- Number of visits required

- Specialist referrals or lab work

- Desired longevity and aesthetic quality

Just like home renovations — building on a weak foundation requires more work, time, and cost.

Why Are Dental Procedures So Expensive?

There’s a common misconception that dentists charge exorbitantly. But consider the following:

- Dentists undergo years of medical training

- Equipment like X-ray machines, dental chairs, and sterilizers are expensive

- Lab work (crowns, dentures) can cost hundreds per unit

- Staff wages, overheads, rent, insurance, and compliance costs

A typical dental clinic reinvests up to 80% of patient fees into maintaining the practice.

Dental Insurance: What Does It Really Cover?

Dental insurance in Australia rarely covers 100% of treatment. Key takeaways:

- Preventive care (check-ups, cleanings) – often 60%–100% covered

- General restorative (fillings, simple extractions) – partly covered

- Major dental (crowns, bridges) – usually partial cover

- Cosmetic treatments (veneers, whitening) – typically not covered

Each policy differs. Always check item numbers with your insurer after your consultation.

Public vs Private Dental Care

Public Dental Services:

- Available to concession card holders

- Long wait times (often over a year)

- Emergency treatments prioritized

Private Dental Services:

- Faster access

- Broader range of services

- Higher quality materials and care options

There’s a trade-off: public is slower but cheaper; private is faster and more comprehensive.

Does Medicare Cover Dental Work?

Generally, Medicare does not cover routine dental treatments.

Exceptions include:

- Child Dental Benefit Schedule (CDBS) – for eligible children aged 2–17

- Public emergency care in hospitals

- Medical conditions requiring dental intervention

If you rely on Medicare alone, your options are extremely limited.

Dental Insurance Tips: Maximize Your Value

- Choose policies with higher annual limits

- Use preferred provider clinics (for higher rebates)

- Understand annual and lifetime limits

- Combine general and major cover if planning significant work

- Keep track of when your benefits reset (usually Jan 1)

Understanding Rebates and Out-of-Pocket Costs

Rebates are what your insurer pays you back. Out-of-pocket is what you pay after the rebate.

Example:

- Crown cost: $1,500

- Insurance rebate: $600

- You pay: $900 out-of-pocket

Always ask your dentist for the item numbers, and confirm with your health fund what they’ll cover before starting treatment.

Dental Financing Options

Worried about large upfront fees? Many clinics offer payment solutions:

- Interest-free payment plans (weekly/fortnightly)

- Third-party finance (e.g., ZipPay, AfterPay, MediPay)

- Staggered treatment planning (prioritize urgent work first)

At Dr. Zenaidy Castro’s practice, we work with patients to create affordable timelines without compromising care.

What’s Covered Under Different Treatment Categories?

| Treatment Type | Examples | Typical Coverage |

|---|---|---|

| Preventive Dental | Cleanings, fluoride, x-rays | 60–100% |

| General Restorative | Fillings, simple extractions | 40–70% |

| Major Dental | Crowns, bridges, dentures | 20–50% |

| Orthodontics | Braces, retainers | Limited or capped |

| Cosmetic Dental | Veneers, whitening | Usually not covered |

Common Dental Fees in Melbourne (Estimates)

| Treatment | Price Range (AUD) |

| Check-up & Clean | $120 – $250 |

| White Filling (Small) | $120 – $200 |

| Tooth Extraction | $150 – $350 |

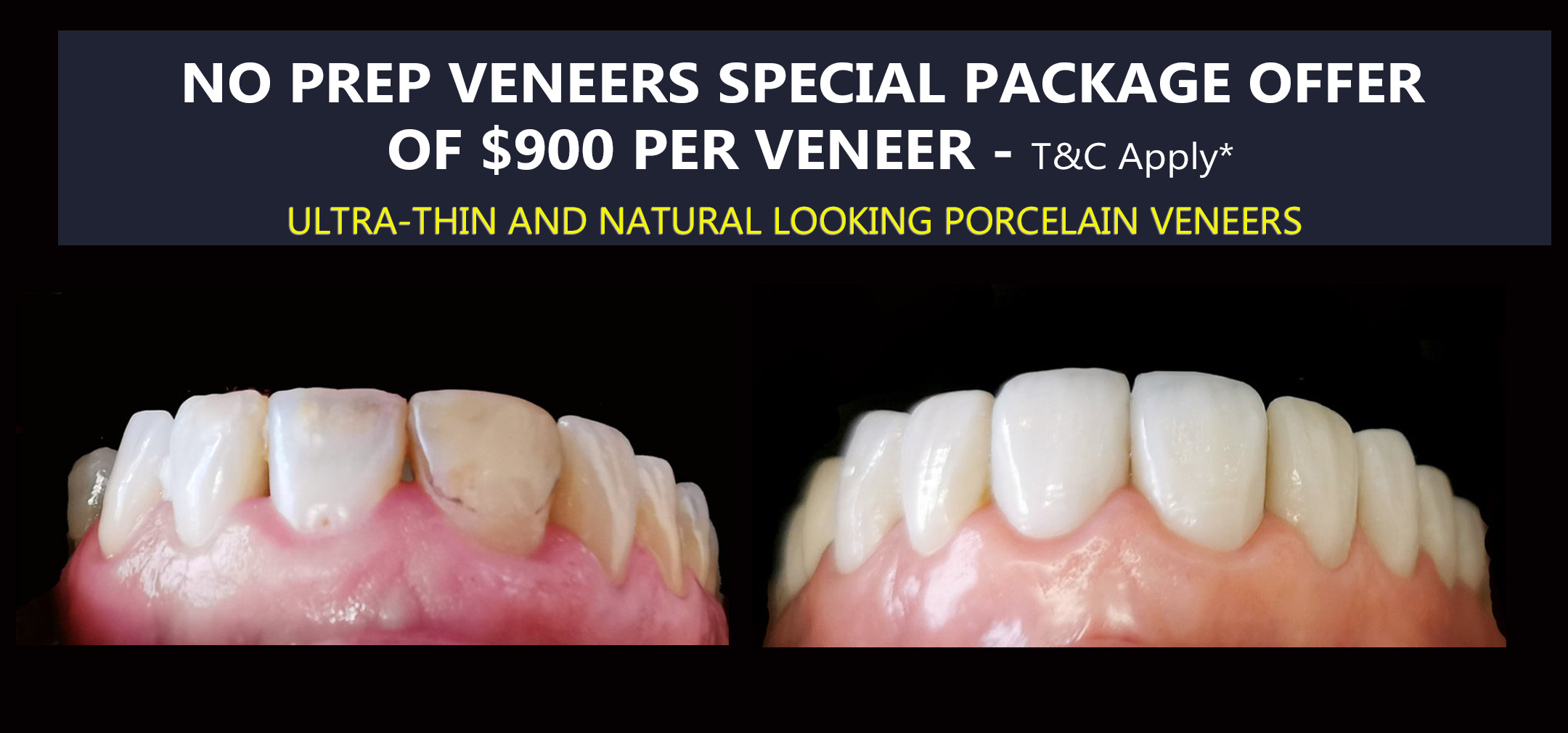

| Porcelain Veneer (per tooth) | $900 – $2,500 |

| Dental Crown | $1,200 – $2,500 |

| Dental Implant (per tooth) | $4,000 – $6,500 |

| Zoom Whitening | $500 – $900 |

Tips to Lower Your Dental Costs in Melbourne

- Keep up regular cleanings to prevent decay

- Avoid sugary snacks and acidic drinks

- Get dental check-ups at least twice a year

- Ask your dentist about lower-cost material options

- Consider staged treatments over time

- Look into community dental programs or university dental schools

What’s the True Cost of Delaying Dental Work?

| Delayed Treatment | Could Lead To | Potential Cost Increase |

| Small cavity | Root canal, crown | $150 → $2,000+ |

| Bleeding gums | Advanced gum disease | $150 → $3,000+ |

| Missing tooth | Bone loss, shifting teeth | $0 → $4,000+ implant |

Procrastination comes with a price tag — sometimes even tooth loss.

Frequently Asked Questions

Q: Why are prices in Noble Park North different from Melbourne CBD?

A: Clinic location influences rent and overhead. Suburban clinics often have slightly lower fees, but the difference isn’t always dramatic.

Q: Does skipping my scale and clean really matter?

A: Absolutely. Plaque buildup leads to decay and gum disease. Prevention is cheaper than treatment.

Q: What if I don’t have insurance?

A: Many clinics offer discounts for upfront payments or can arrange payment plans. Ask your dentist.

Conclusion: Plan, Prevent, Protect

Dental work isn’t cheap, especially in Melbourne or Noble Park North, but neither is neglecting your oral health. With a clear understanding of costs, insurance coverage, and available options, you can make empowered decisions for yourself and your family.

Book a consultation. Ask questions. Explore financing. And most importantly — never postpone preventive dental care.

Need expert advice or a personalized quote?

Call us now:

☎ 9629-7664 | 0413 014 122

REQUEST AN ONLINE PERSONALIZED QUOTE ➤ REQUEST FOR A FREE TELECONSULTATION ➤

Let your Healthy smile be your strongest investment — even in tough economic times.

✨ At Vogue Smiles Melbourne, we see your smile as a lifelong investment—and we’re here to make it healthy, confident, and truly unforgettable.

Your comfort and confidence matter. Whether you’re after a simple check-up or a complete smile makeover, our caring team in Melbourne CBD & Noble Park North is here to help. Don’t wait until pain or insecurity grows—explore your options now.

Affordable. Gentle. Life-changing.

Book your FREE consultation and discover how our expert care and flexible payment plans can help you smile with pride.

Your Healthier Smile Starts Here – Book a Consultation

📞 Call (03) 9629 7664 | 0413 014 122

REQUEST AN ONLINE PERSONALIZED QUOTE ➤

REQUEST FOR A FREE TELECONSULTATION ➤

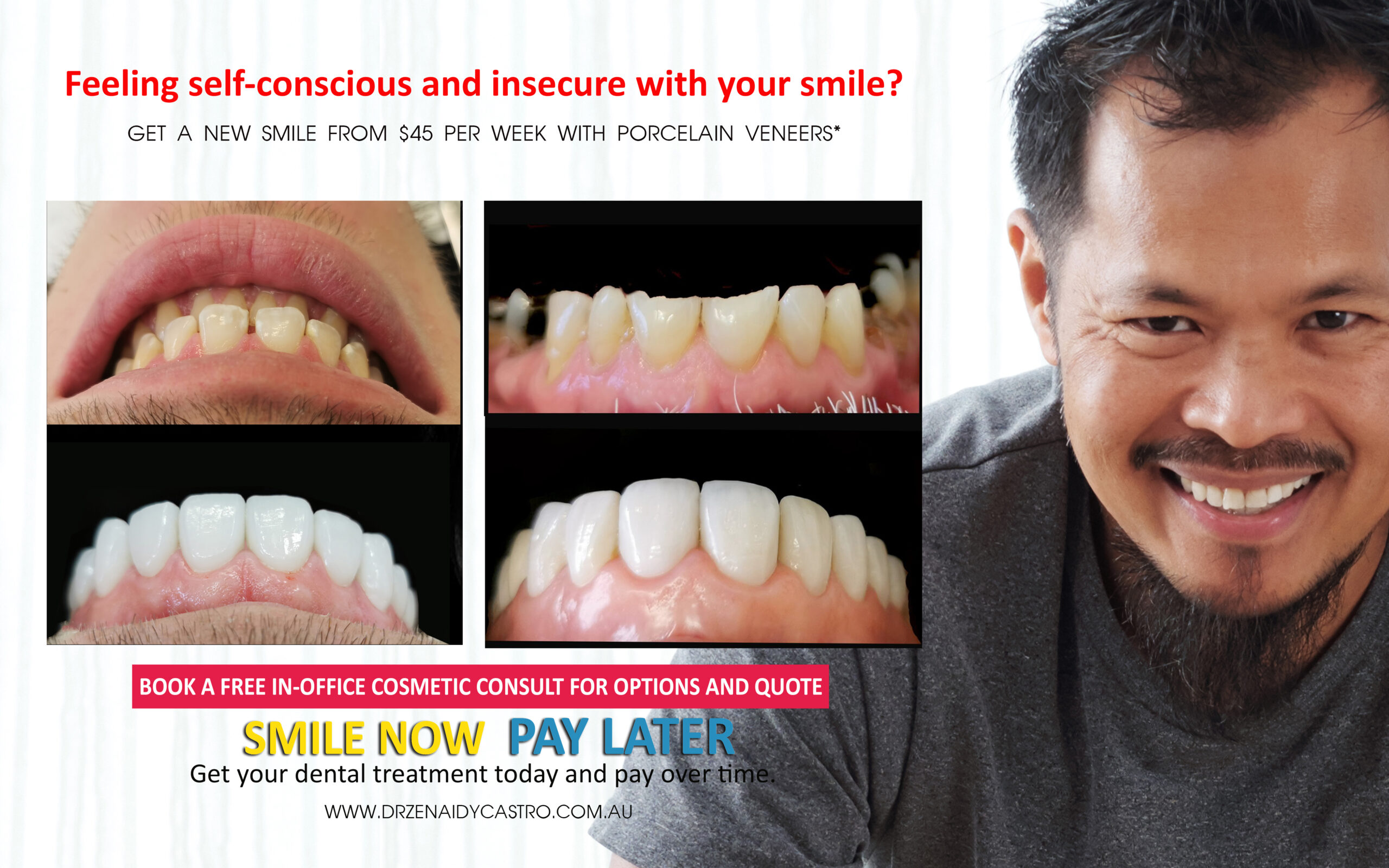

“See the Smiles We’ve Transformed — Yours Could Be Next!”

Transformations That Inspire — See Our Stunning Before & Afters

Make Your Dream Smile Affordable – Ask Us About Your Payment Options & Super Access Options

Transform Your Smile Without the Financial Stress! Explore easy, affordable options to fund your dream smile makeover — choose from interest-free dental financing or access your superannuation for dental treatment. Take the first step toward a confident new you —contact us today (03) 9629 7664 | 0413 014 122 for a free consultation! Alternatively, you can send us an email.

FIND OUT MORE:

Accessing your superannuation for dental treatment in Australia

Expenses eligible for release on compassionate grounds for Super Access

Get the treatment that you need with Dental Financing Offer of up to 4 years with TLC

Enquire to TLC Weekly or Monthly repayment Quote 1 300 045 047

Apply for TLC Dental Financing

Explore other Financing options and see if you are Eligible for dental finance

More Than a Dentist– Meet Dr. Zenaidy Castro, Artist and Visionary

Welcome to the world of Dr. Zenaidy Castro — a passionate and skilled cosmetic dentist who not only transforms smiles but also expresses beauty through fine art and photography. Beyond the dental chair, Dr. Castro is a visionary abstract artist and accomplished photographer, known for creating emotionally rich and visually stunning masterpieces. She is the founder of Heart & Soul Whisperer Art Gallery, an online gallery showcasing her unique artistic voice that blends emotion, color, and soul.

We invite you to explore her creative universe at Heart & Soul Whisperer Art Gallery and discover how her artistic spirit inspires everything she does — from designing beautiful smiles to capturing the beauty of life through her lens and canvas. Check Dr Castro’s curated Black and white Fine art Photographs

Disclaimer:

The information on this website is for information purposes only. Is not a substitute for a proper professional care and advice. Each patient’s outcomes, risks, potential complications, and recovery differ. Any dental procedure, minor or major, carries risks, some minor and some serious. Before and after images seen on our Social Media and website pages are our actual patient and have been published/posted with our patients’ permission. All of our patients photos are subject to Copyrights protection. We are strong believers in responsible aesthetics. Every cosmetic, medical, or dental procedure comes with its own set of risks and benefits. Cosmetic Dentistry results will vary from patient to patient. Call our office and book for an actual in-office consultation for us to assess if you are a good candidate for a particular treatment. All of our Specials and packages posted on this site are subject to terms, conditions and availability. The exact fee for a particular cosmetic procedure will be determined after a preliminary assessment distinguishing your unique personal needs and the type of work needed. The prices mentioned on any of our website as well as any mentioned payment plan by a third party source, are just a guide and is subject to change. Call the third party financing providers or visit their website for more info. Please call the office on 9629-7664 for further queries or clarification.